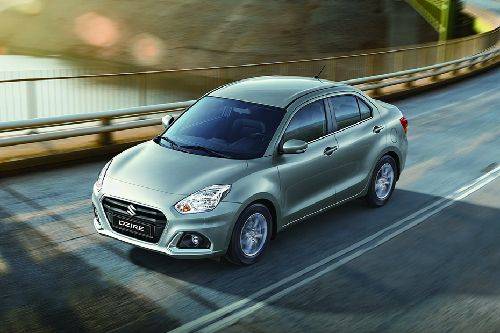

BPI 'Auto Loan Multiyear Protect' package offers easy vehicle ownership and coverage

MANILA: The Bank of the Philippine Islands (BPI) introduced recently its “BPI Auto Loan Multiyear Protect,” a new product that provides car loan clients with an automobile insurance policy that lasts for the whole duration of the loan.

This loan solution puts together monthly insurance installments and loan amortization payments in a more convenient and cost-efficient package.

The Auto Loan Multiyear Protect provides different benefits such as paced payments and insurance renewal.

BPI Retail Loans Group Head Dennis Fronda said, “Multiyear Protect prioritizes our customers’ convenience and peace of mind because it was designed to eliminate the financial worries and administrative hassles a typical car loan client experiences today.”

Fronda also explained that the new features of the Auto Loan Multiyear Protect provides customers greater flexibility in handling their cash flow into fixed and partial monthly payments throughout the entire duration of the loan. It also helps customers worry less about unexpected auto repair expenses brought about by road accidents.

Fronda explained, “We wish to provide customers the confidence to pursue their dreams of owning a car today and give them the premium experience they deserve. On a larger scale, we also hope that this will translate to better consumer confidence that will result in more car sales and help the auto industry bounce back this year.”

BPI worked together with BPI M/S Insurance Corporation to promote this convenient, holistic, and hassle-free experience for vehicle owners.

Auto Loan customers will now have the opportunity to drive with convenience through the Multiyear Protect’s exclusive feature — a Guaranteed Asset Protection (GAP) insurance that offers up to P200,000 additional coverage, especially if the vehicle undergoes total loss.

Customers can also benefit from reduced upfront costs when purchasing their preferred vehicle because the insurance cost is split into smaller monthly installments.

Fronda added, “Auto Loan Multiyear Protect is one of our ways to show our commitment to provide customers with reliable and relevant financial solutions, so we can all have opportunities for better times ahead.”

Interested applicants can visit the website of BPI Loans here to find out more about the Multiyear Protect. They can also go to any BPI or BFSB branch across the country to discuss with the bank’s specialized loan advisors.

Photo from BPI

Also read: What’s it like to get an auto loan during the pandemic?

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Carmudi

- journal

- advice

- financing

- insurance