BPI turns 171, offers up to P171K in waived auto and housing loan, insurance fees

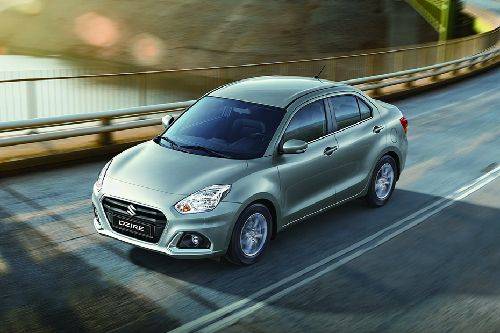

MANILA: The Bank of the Philippine Islands (BPI) is upgrading its loan offers as it celebrates its 171st year with a month-long promo that will waive up to P171,000 in loan fees for auto and housing loans as well as insurance from its non-life insurance arm, BPI MS Insurance Corp.

KEY TAKEAWAYS

When should clients submit their application and book their loan to be eligible for the promo?

Applications submitted between August 1 and August 31 and booked on or before September 30 are eligible for the promo.What is the minimum loan term and minimum loan amount?

The minimum loan term is five years and the minimum loan amount is P500,000.In a statement, BPI Retail Loans Group Head Dennis Fronda said, “This offering proves our thrust of being customer-obsessed. As we mark our 171st anniversary in the business, this is one of the many ways we are thanking our customers for the trust and support they have given BPI throughout the years. This also marks our first year since BPI and BPI Family Savings Bank (BFSB) merged as One BPI.”

The loan promo, which is available to both new and existing BPI depositors, allows clients to have an initial cash-out equivalent to just the down payment. It offers free chattel mortgage fee and free first-year vehicle insurance for auto loans.

Individual applicants can apply for the auto loan online, at dealers, and in branches. The auto loan applies to brand-new passenger cars and should be for personal or private use only.

Applications submitted between August 1 and August 31, and booked on or before September 30 are eligible for the promo. The minimum loan term is five years and the minimum loan amount is P500,000. It can be combined with loan programs like Step Up and Zero Cash Out as well as other exclusive partner offerings. The free first year of insurance is not applicable when using Auto Loan Multiyear Protect.

BPI will not accept pre-termination or pre-payment of the loan for the auto loan deal.

BPI revealed that its auto loan portfolio increased by 4% in the first half of 2022 versus the same period pre-pandemic or in 2019. A total of P409 billion auto loans were booked.

“Since the merger as One BPI, the bank has been providing innovative loan offerings to our clients, continuing the legacy of BFSB,” Fronda added. “We remain committed to serve our growing customers with products and services that make us one of the country’s trusted financial partners.”

Photo from Bank of the Philippine Islands

Also read: PSBank offers lower loan rates on Toyota hybrid models until Aug. 30

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

PIMS 2024

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance