MPT DriveHub now offers CTPL

New product offered in partnership with M Pioneer Insurance

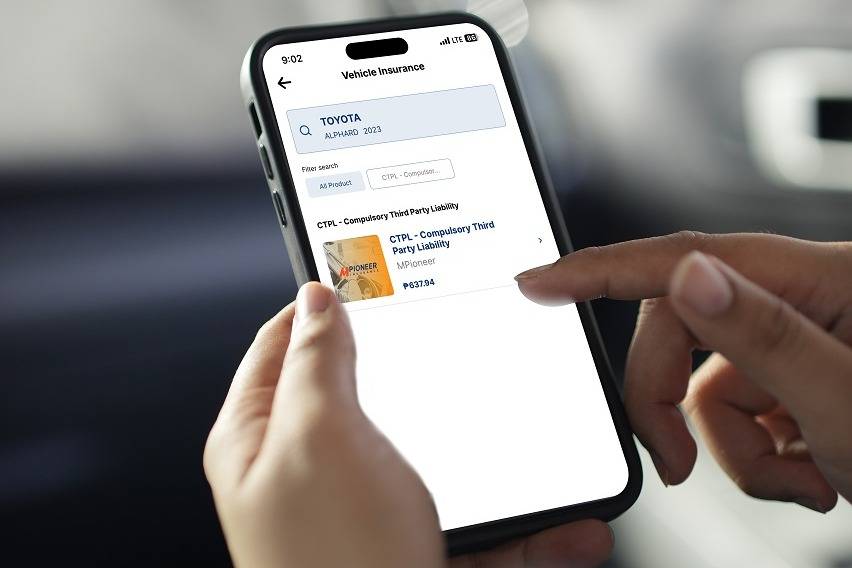

MANILA: MPT DriveHub has started offering compulsory third-party liability (CTPL) insurance.

KEY TAKEAWAYS

Who is MPT Drivehub's partner for its compulsory third-party liability insurance?

The new product is offered in partnership with M Pioneer Insurance.Why is CTPL important?

CTPL is designed to cover costs related to bodily injury or death of third parties resulting from vehicle accidents.In a statement, MPT Mobility said that the latest product — created in partnership with M Pioneer Insurance Incorporated — is now offered in the mobile app to address a “vital aspect of vehicle ownership.” This, the company noted, ensures that users are well-protected and compliant with legal requirements.

One of the requirements mandated by the Land Transportation Office to register a vehicle, CTPL is designed to cover costs related to bodily injury or death of third parties resulting from vehicle accidents.

Photo from MPT Mobility

Photo from MPT Mobility“We’re thrilled to partner with M Pioneer Insurance Incorporated in this huge milestone,” MPT DriveHub Vice President Gines Barot shared, saying that the enhancement “represents a major advancement in MPT Mobility’s mission to elevate the driving experience for all Filipinos.”

“By incorporating CTPL insurance directly into MPT DriveHub, we offer users effortless protection and peace of mind, ensuring they are well-prepared for any third-party liability situation. This feature simplifies legal compliance and reinforces our commitment to making vehicle ownership more convenient and secure,” he added.

According to the Metro Pacific Tollways Corporation (MPTC)-led firm, its MPT Drivehub consolidates key features including the ability to easily view current and past policy coverages and browse through an extensive FAQ (frequently-asked questions) section.

“The app simplifies sign-ups with saved vehicle data, organizes document uploads, and facilitates hassle-free claims initiation. Additionally, the auto-renewal feature ensures timely vehicle registration renewals. The integration of CTPL insurance into the MPT DriveHub app significantly enhances its value, creating a more seamless, efficient, and secure driving experience across MPTC Expressways,” the company explained.

Photo from MPT Mobility

Photo from MPT Mobility“Our partnership with MPT Mobility has allowed us to simplify car insurance processes, ensuring legal compliance and reducing financial risk. By streamlining the process through MPT DriveHub, we promote convenience and informed decision-making. We also enrich the overall customer experience, foster customer satisfaction, and ensure that in times of need, help is readily available,” assistant to the Vice President and CEO of M Pioneer Atty. Olivia Valera was quoted as saying.

Additionally, MPT DriveHub users can take advantage of the streamlined process that eliminates the need for separate insurance providers and multiple transactions.

Such an integration simplifies insurance management and “aligns with MPT Mobility’s long-term vision of providing a comprehensive mobility solution and delivering a unified platform that combines convenience, protection, and innovation for an improved driving experience.”

“Delivering its promise as an all-in-one travel companion app, MPT DriveHub offers a wide range of services—from RFID balance monitoring and reloading to ensuring third-party liability coverage,” Barot added.

Also read:

MPT Mobility acquires AACI to expand tech-based mobility solution offerings

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Carmudi

- journal

- advice

- financing

- insurance