Car Insurance 101: What Every Car Owner Needs to Know

- KEY TAKEAWAYS

- Legal requirements for car insurance

- Understanding the types of car insurance coverage

- Compulsory third-party liability insurance

- Comprehensive car insurance

- Personal accident insurance

- Factors affecting car insurance premiums

- Vehicle type and age

- Location and usage patterns

- Choosing the right car insurance provider

- Research about insurance providers

- Compare coverage and premiums

- Check customer reviews and ratings

- How to file a car insurance claim

- Report the incident to the insurance company

- Document the damage and gather evidence

- Follow the claims process

Car insurance is an essential aspect of being a responsible car owner. Whether you have just purchased a brand-new vehicle or are driving a well-loved car, understanding the ins and outs of car insurance is crucial for protecting yourself, your vehicle, and others on the road.

KEY TAKEAWAYS

What is the minimum car insurance required by law in the Philippines?

In the Philippines, the minimum car insurance required by law is the Compulsory Third Party Liability (CTPL) insurance. This covers the legal liabilities to third parties in case of bodily injury or death caused by your vehicle.How can I find the best car insurance deal?

To find the best car insurance deal in the Philippines, it is important to research and compare different insurance providers. Consider factors such as coverage options, premiums, customer reviews, and ratings. Additionally, it can be helpful to seek recommendations from friends, family, or trusted sources who have experience with specific insurance companies.Here’s a comprehensive guide to car insurance in the Philippines, providing you with the necessary knowledge to navigate the various coverage options, factors affecting premiums, choosing the right insurance provider, and filing claims.

Legal requirements for car insurance

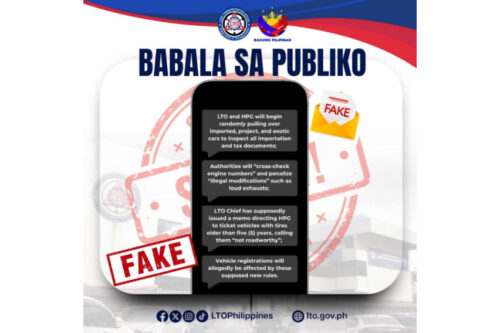

In the Philippines, having car insurance is not just a matter of personal choice — it's mandated by the law. The Land Transportation Office (LTO) requires all motor vehicles to have at least a compulsory third-party liability insurance coverage.

This means that if you cause damage to another person's property or injure someone with your vehicle, your insurance will cover the costs up to a certain limit. So, if you do not want to end up in legal trouble, make sure you have the right insurance coverage.

Understanding the types of car insurance coverage

Compulsory third-party liability insurance

CPTL covers the costs of damages or injuries caused by your car to other people or their property. So, if you accidentally rear-end someone or scratch someone's fancy car, your insurance will come to the rescue.

Comprehensive car insurance

Comprehensive insurance protects you from a wide range of risks, including theft, fire, and natural disasters. It covers damages to your own car and also includes the benefits of third-party liability insurance.

Personal accident insurance

Cars can be unpredictable, and accidents can happen to even the most careful drivers. Personal accident insurance provides coverage for injuries or death resulting from car accidents. It is like having a cushion of financial support to help you or your loved ones recover after an unfortunate event.

Also read: Here are the common mistakes owners make when buying auto insurance

Factors affecting car insurance premiums

Vehicle type and age

The more expensive your car is, the higher your premium will likely be. The age of your car also plays a role, as older cars may have higher risks of breaking down or being stolen.

Location and usage patterns

Where you live and how often you use your car can also affect your insurance premiums. If you live in an area with high crime rates or heavy traffic, insurers might consider you to be at a higher risk for accidents or theft. Similarly, if you use your car for long daily commutes, your premium may be higher compared to someone who only uses their car occasionally. So, keep in mind that where and how you drive can impact the cost of your insurance.

Also read: Standard Insurance now allows interest-free 12 monthly installments on car insurance premiums

Choosing the right car insurance provider

Research about insurance providers

Take the time to research different insurance companies and their reputations. Look for providers that have a good track record and are known for their prompt claims processing. After all, you want someone who will be there for you when you need them the most.

Compare coverage and premiums

Don't just go for the first insurance policy that catches your eye. Take the time to compare coverage and premiums from different providers. Look at what each policy includes and excludes, and make sure it suits your needs. Also, consider the deductible amount, which is the portion of the claim you have to pay out of pocket.

Also read: MAPFRE insurance offerings guarantee protection on the road

Check customer reviews and ratings

In the age of the internet, you have the power to uncover what other customers have to say about insurance providers. Check online reviews and ratings to get a sense of how satisfied or dissatisfied customers are with a particular company. While no company is perfect, paying attention to customer feedback can give you valuable insights and help you make an informed decision.

How to file a car insurance claim

Report the incident to the insurance company

The first step is to report the incident to your insurance company. They will guide you through the claims process and give you all the necessary information to file your claim successfully.

Document the damage and gather evidence

Take photos of the damage to your car, the other party involved (if any), and any relevant details like license plates or street signs. You will also need to provide a written account of what happened. Remember, the more evidence, the better.

Follow the claims process

Once you have reported the incident and gathered all the evidence, it is time to follow the claims process laid out by your insurance company. This may involve filling out some paperwork, submitting the requirements, and waiting for your claim to be processed.

Among the requirements that must be presented to the insurance provider are the policy, a policy report or a notarized affidavit executed by the assured or the authorized driver thereof, photocopy of the certificate of registration and official receipt of the insured unit, photocopy of the driver’s license and official receipt of the person driving when the accident occurred, pictures of the damage sustained by the unit showing the damage and the whole car with license plate visible, and repair estimate.

Your insurance company will review your claim and either approve it or provide you with a detailed explanation if it is denied.

Photos from Standard Insurance, Land Transportation Office, Malayan Insurance, and Philippine News Agency

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance