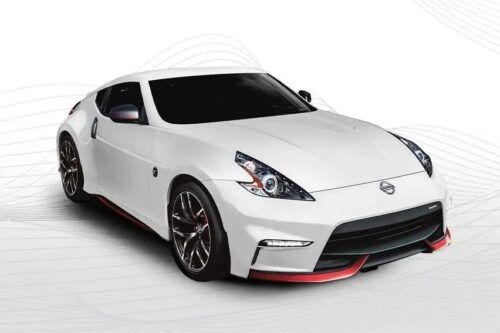

Auto Loan Made Easy Only at Zigwheels

- Lowest Interest Rates

- Lowest down payment

- Fast & safe process

How do I Apply?

Follow these steps to get a Quick, Simple and Hassle-Free loan on your vehicle

-

Share Basic Details

Share personal details along with loan requirements and the details of the vehicle for which the loan is to be obtained.

-

Input Loan Requirement

If the customer approves the system-generated loan details, they can fill in personal detail & fulfil other information requirements.

-

Submit Documents to the Bank

Upload all required documents to the Bank for approval.

-

Leave the rest to us

Loan disbursal process initiated.

Auto Loan Calculator

Calculate the monthly EMI based on vehicle loan amount, Tenure and Interest rate

- Car Loan

- Used Car Loan

- Motorcycle Loan

*The rate mentioned in the calculator is an indicative rate only. The actual rate may vary.

*Rate of interest can vary subject to credit profile. Loan approval is at the sole discretion of the finance partner.

*Fees such as insurance, administrative, provision fees, etc. are not included in the simulation.

*The simulation is only a general description and is not the actual amount. The final amount will be determined by the financier.

*The base price (Total cost) is calculated subject to the price of the popular models available in your selected area

*Rate of interest can vary subject to credit profile. Loan approval is at the sole discretion of the finance partner.

*Fees such as insurance, administrative, provision fees, etc. are not included in the simulation.

*The simulation is only a general description and is not the actual amount. The final amount will be determined by the financier.

Vehicle Loan Eligibility & Documents Required

- Eligibility

- Documents

- Filipino citizen between the age of 21 - 65 years, however, not exceeding 65 years at the time of loan maturity

- A joint monthly income of at least Php 30,000 (Php 40,000 for some banks)

- Any salary earning individuals, sole proprietorship, partnership firm, self-employed individuals, public listed companies, private limited companies can apply for a car loan

- Filipinos working or living in other country as OFWs with a related or qualified citizen or guarantor or co-maker

- Foreigners living or working in the Philippines endorsed by the company with a qualified co-maker/Filipino citizen guarantor

FAQ’s on Vehicle Loan in Philippines

What is a car and motorcycle loan?

-

A car and motorcycle loan helps a buyer with the purchase of the preferred vehicle. The lender can be either a bank or a financial institution which will lend money to the applicant. The loan is required to be repaid by the borrower with interest over a predetermined time period.

What are the advantages of taking car and motorcycle loans?

-

There are several advantages of taking a loan when planning on buying a car or a motorcycle. It is even better than purchasing the commodity in cash. Some of the advantages of taking a loan are - easy equated monthly installments, no need to provide any collateral, builds credit history, along with insurance & road tax benefits.