Suzuki PH presents online auto loan feature

MANILA: The “new normal” is starting to take shape as businesses gird to restart operations after the enhanced community quarantine (ECQ) lifts – presumably to be replaced by a more relaxed general community quarantine (GCQ). As a vaccine for the dreaded coronavirus strain remains elusive, physical distancing protocols need to be observed for everyone’s safety and protection.

Suzuki Philippines, Inc. (SPH) is among those businesses looking to evolve to meet the unique challenges of this age of the pandemic while making services and products available to more customers.

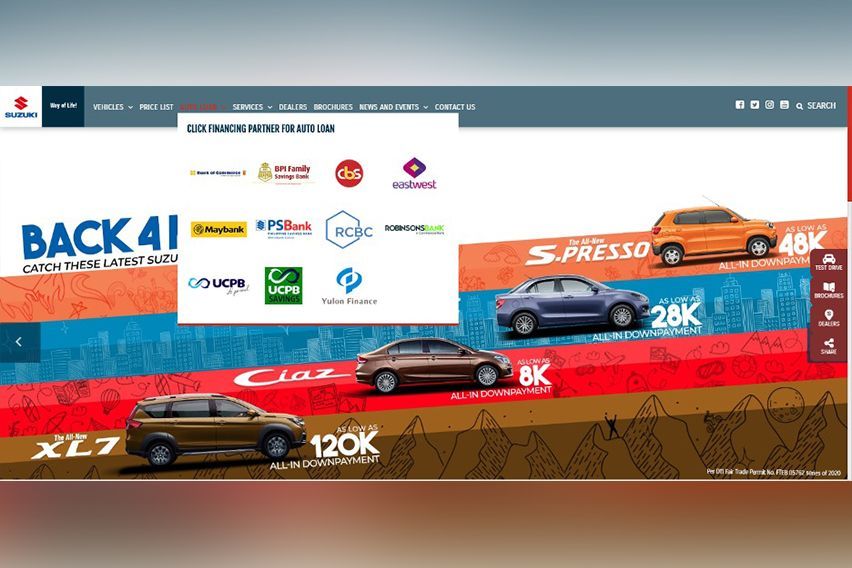

SPH now banners its Auto Loan feature found on www.suzuki.com.ph which makes getting a new car vastly easier through financing. SPH partners with the Bank of Commerce, Bank of the Philippine Islands, Chinabank Savings, East West Bank, Maybank, PS Bank, RCBC, Robinsons Bank, UCPB, and Yulon Finance — with the Auto Loan feature directing prospective buyers to their preferred bank’s website page dedicated for car loans. The bank of choice will then be able to evaluate the applications for possible approval.

SPH says that this new functionality was brought about the present situation when “consumers are longing for a sense of security and reliability, more than just the product itself.”

Almost simultaneous with the imposition of the ECQ in NCR, Suzuki had introduced locally its XL7 and S-presso products.

Photo from Suzuki Philippines

Also read: Suzuki, DOTr partner for free rides for COVID-19 frontliners

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

PIMS 2024

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance