Truck tax exemption at risk as reform bill reaches House

MANILA: According to the Philippine News Agency, the Comprehensive Tax Reform Program's (CTRP) final package, which was a priority for President Ferdinand Marcos Jr. during his first State of the Nation Address, was sponsored before the House of Representatives' plenary on Wednesday.

KEY TAKEAWAYS

Why did the DOF propose to remove the excise tax exemption on pickup trucks?

According to DOF, the authorities have observed that manufacturers modify pickup trucks so they can be used as passenger, recreational, or sports vehicles. This strategy allows manufacturers to get around the law's restrictions and the exemption's purpose.How much will be the additional tax collections once the excise tax on pickup trucks is imposed?

Once the excise tax on pickup trucks is imposed, DOF estimates that additional tax collections will hit P52.6 billion from 2022 to 2026.House Bill 4339 would streamline the taxation of passive income, financial services, and transactions by reducing the number of tax rates from 83 to 58, according to Rep. Joey Sarte Salceda, chair of the House Ways and Means Committee, who spoke in support of the bill.

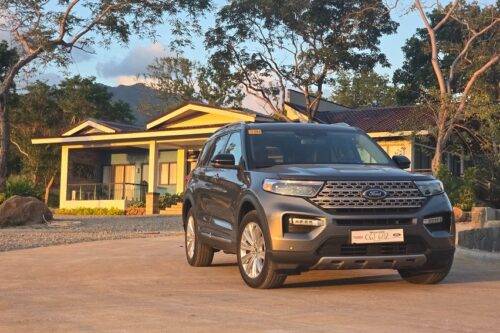

The excise tax exemption for pickup trucks introduced by Republic Act 10963, often known as the Tax Reform for Acceleration and Inclusion (TRAIN) law, is eliminated as part of the bill's "clean-up" of the CTRP.

The Ways and Means Committee of the House of Representatives passed an extended plan that included the imposition of excise taxes on pickup vehicles in a prior report.

The Passive Income Financial Intermediary Taxation Act (Pifita), formerly known as, was expanded upon by the Department of Finance (DOF), among other changes being the elimination of the pickup vehicle excise tax exemption.

“Pickup trucks were granted the special tax treatment for their utility as workhorses for small business owners and professionals in their livelihood,” DOF Secretary Benjamin Diokno said in his letter to Ways and Means Committee Head Rep. Joey Salceda.

“The Department of Trade and Industry has observed that manufacturers modify pickup trucks to serve as passenger, leisure or sports utility vehicles. This scheme allows manufacturers to circumvent the provision of the law and purpose of the exemption,” Diokno reasoned.

Once the excise tax on pickup trucks is imposed, DOF estimates that additional tax collections will hit P52.6 billion from 2022 to 2026.

The CTRP proposal also aims to remove the documentary stamp tax (DST) on certificates.

Common employment requirements such as the National Bureau of Investigation (NBI) clearance, birth certificates, diplomas, and transcripts of records will no longer be subject to the DST, the report added.

Photos from Roy Robles

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

PIMS 2024

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance