Responsible car-buying in the time of COVID-19

As the DOTr (Department of Transportation) slowly opens more routes on the way to allowing PUBs (public utility buses) and other modes of transportation to operate, you could still be thinking, “Is it safe to ride PUVs (public utility vehicles) yet?”

Countries like the United Kingdom are actually dissuading people from riding buses and trains. “The Government urges people to avoid public transport wherever possible in the wake of the COVID-19 pandemic,” said Mark Carpenter, CEO of Motorpoint.

So it’s understandable why our own government is taking the opening of PUVs really slow. A misstep could land us right back where we were in March.

If you don’t have a car and are thinking of buying one just to avoid the crowds at the MRT and loading areas, that’s a very valid reason, and I’m sure you’re not the only one. Just remember that there are so many more things you must take into consideration when thinking of acquiring a vehicle — especially in the "new normal."

Capacity to pay

Financial experts say you should only allot 10% of your gross monthly income for auto payments. You can stretch it to maybe 12 to 15% but at this rate you could be giving up your daily latte or even the monthly gadget budget.

Don’t go any higher because it might eat up money for essential expenses like house payments, water and electricity bills, etc.

From a bank’s point of view, if the monthly amortization of the vehicle you intend to buy exceeds 30% to 40% of your salary, your loan application will most likely get disapproved, says Ton Carabeo, Bank of Commerce channel manager.

Loan from a bank or a dealership?

Some auto dealerships will let you take a car home for a low, low all-in downpayment of just P10,000. As good as that sounds, the monthly amortization for that baby will be through the roof.

As an example, let’s say you have 15% of P1.035 million, which is the price of a Honda BR-V 1.5 S CVT. You put all that (P155,250) as down payment. Even if you spread the payment terms out to a max of 60 months, you’re still coughing up P21,745.95 per month.

For lighter monthly payments, make sure you at least have 20% of the vehicle’s total cost, then get a bank PO (purchase order). Add-on rates are much lower and if you have a good relationship with the bank, you can even bring it down to as low as 24%. That’s more than half of what auto dealers will give you. You could even nego the price of chattel mortgage and insurance.

Depreciation

Your close-to-a-million-peso vehicle will lose 10% of its value as soon as you drive out of the dealership. Shave off another 20% after one year all the way to a whopping 60% after five years.

Knowing this before you sign on the dotted line gives you an idea of what your vehicle will be worth if you intend to sell it after a certain number of years.

Depreciation also differs among models and brands.

Ownership costs

Items here are what a lot of new auto buyers forget, which leads to vehicles getting repossessed.

After the warranty expires, every service and part for your vehicle will come out of your pocket. Plus, the older your vehicle gets, the more care it needs. But that’s still loose change compared to repairs for damage caused by accidents, which could run up to the hundreds of thousands.

What can save you from big expenses like that is insurance and I’m not talking about third-party liability (TPL) insurance. This only covers liability (expenses you’ll have to shoulder) of the insurer (that’s you) in the event you accidentally injure a third party (pedestrians, other drivers, your passengers that are not members of your household or family and are beyond the 2nddegree of consanguinity). My advice is to get comprehensive insurance because it covers all repair-related expenses, and the insurance company will even do all of the paperwork and legwork for you.

Finally, don’t forget parking fees. Be a responsible owner and don’t just sequester the road space in front of your house. Build a garage for your vehicle and set aside budget for daily parking at the office.

Documents you’ll need

Two valid IDs, a certificate of employment, bank certificate and a copy of your Income Tax Return.

If your salary does not reflect the amount required for the loan, get yourself a co-maker. This is someone who will tell the bank that they’ll pay the loan for you, but they don’t get to take home the vehicle.

Spouses are automatically co-makers of their significant other; banks require this arrangement. If legally separated, a waiver is necessary before the loan can be processed.

Happy shopping!

If your mind is made up, you’re unperturbed, and you see yourself in the clear even after computing for all ownership expenses, then let me thank you in advance for helping kick start the economy because we’re going to need all the help we can get.

Last and most important of all, while we urge you to enjoy the car shopping experience because it doesn’t happen every day, do so while following the current health and safety protocols.

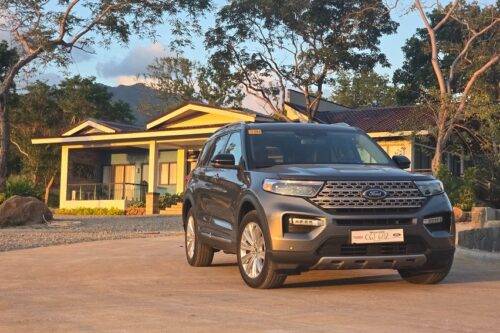

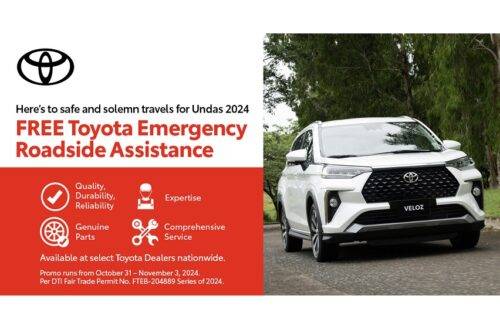

Photos courtesy of Toyota, Renault

Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

PIMS 2024

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance